Throw

a stone at a group of people and I’ll give you great odds that it will

hit a person who is regretting not investing in bitcoin or any other

cryptocurrency for that matter when they had a chance a few months ago.

Cryptocurrencies might still be a good bet to invest on, but then it

will be difficult to replicate the kind of returns it gave in the past

12 months.

Well, cryptocurrencies are still infants when compared to traditional methods of investing money.

One

of the earliest ways to invest money was to lend it to people, friends

or relatives and collect interest on the principle supplied. Then after

that, the stock market and real estate became the go-to markets for

investors.

However,

this seemingly ancient method of peer-to-peer lending has found its way

back to the modern world with the help of a team of people who go by

the name — FintruX.

Actually,

the concept of peer-to-peer lending was never extinct. Banks use the

same concept albeit on a larger scale. There are also a lot of other

platforms who offer peer-to-peer lending services, but neither solves

the problem of safeguarding lenders while handing out unsecured loans.

What is FintruX and what issues do they want to solve?

FintruX

was developed in 2017 to create an online ecosystem which will connect

borrowers, lenders and rated service agencies directly, in a true

peer-to-peer network sense. The platform will offer start-ups and new

businesses to quick and essential capital to run their operations.

These

new organisations generally find it difficult to get unsecured loans

from the banks and other traditional lending institutions. There are two

reasons for it: Firstly, since the companies are still in their initial

stages, their finances are shaky at best, which makes banks unwilling

to approve the loans.

Secondly,

even if the loans are approved, it takes a few months to complete the

whole process of applying for loans and getting it sanctioned. This

doesn’t benefit the companies who are in a rush to get some capital.

Problems with the incumbent P2P platforms

Yes,

other Peer-to-peer lending platforms are currently available in the

market, but even they come with their share of barriers. These platforms

do serve the borrowers in a better way with a faster and easier online

application process with flexible repayment terms.

Except, since the principle is supplied through a lot of different sources, the interest rates are generally on the higher side.

Moreover,

these platforms only claim to be P2P, but on the contrary to these

claims, they involve a lot of intermediaries such as trust accounts and

other parties, which reduces their level of transparency.

Also,

in most of the platforms like this, the credit risk evaluation process

is inconsistent and leaves a lot of room for improvement, which means

that the lender has to assume all the risks.

How do they solve these issues?

The FintruX team wants to make unsecured loans highly secure by using blockchain technology.

They

are the pioneers of using blockchain in P2P platforms and are planning

to administer smart contracts to configure specialized contracts for

each borrower in real time depending on the agreed upon terms by both

parties in the transaction.

Using

smart contracts, eliminates the need for physical infrastructure,

automates the process and improves the overall lending experience and

reduces the cost too making it cheaper for all the stakeholders.

To

solve the issue of the inconsistent credit rating process, the platform

uses cascading levels of credit enhancements to improve credit

worthiness and to reduce the risks while sanctioning unsecured loans.

This technique guarantees the lender that the borrower will honor his

obligation by over-collateralization

as additional collateral, local third — party guarantor,

cross-collateralization as insurance, and FintruX ultimate protection

reserve

FintruX

will reserve 10% of every money lent transaction to create a buffer

level. So, if any of the borrowers defaults on his repayment, the lender

will be protected by this buffer level provided by the platform.

Due to the improved security, even borrowers can get favorable interest rates.

All

the transactions on the platform to the agencies, guarantors and

FintruX network, whereas the rewards and late charges will happen

through the FTX token.

About the ICO (https://www.fintrux.com)

The token pre-sale will begin on 7th January and is scheduled to run until 21st January.

Investors will be able to exchange 1 ETH for 1650 FTX tokens. The min. transaction amount is 1 ETH.

The presale has a soft cap of 5000 ETH. During the pre-sale, investors will get 10% bonus on their investments.

After

the pre-sale concludes the token sale will start on 7th February. The

exchange rate during this period will be 1 ETH for 1500 tokens. The hard

cap for the token sale is set at 75 million tokens. Investors will also

be awarded bonuses during this period in the range of 5% to 0.6%.

75%

of the total tokens issued are available during the crowd sale, whereas

10% each is reserved for the founding team (with lock-in period) and

the FintruX reserve.

The

funds generated during the ICO will be used to develop the project

further and the remaining funds will be directed towards marketing and

run the operations.

Our Opinion

The core team at FintruX has over two decades of experience in the securitization sector and asset based management.

Their

platform does provide a lot of benefits to all the parties and

stakeholders over the incumbents as we stated earlier in the article.

This can help the platform to get good adoption at the early stages

itself.

Furthermore, they have uploaded wireframes for their platform and a github model for investors to infuse trust in the project.

All

things considered, I would suggest any investor looking to invest in

the blockchain technology to give this project a serious consideration.

FintruX Network makes it easy for small businesses to quickly secure affordable loans with no collateral, in any currency.

The three main competitive advantages of FintruX are:

Credit Enhancements :

By applying credit enhancements, FintruX Network will virtually

neutralize the lender’s credit risk and, in the case of a default,

provide cascading levels of insurance to cover any possible loss. With

risk reduced, lenders have peace of mind and the interest rates for

borrowers is lowered.

No-Code Development :

A unique smart contract is automatically generated and deployed by

FintruX Network for each approved loan in real-time to provide

unambiguous, immutable, and censorship resistant records where no

arbitration is required. This is possible with our no-code development

technology.

Open Ecosystem :

In addition to simplifying the loan application process via instant

matching, FintruX Network also provides borrowers with post-funding

self-serve administration options and access to third party rated

agencies.

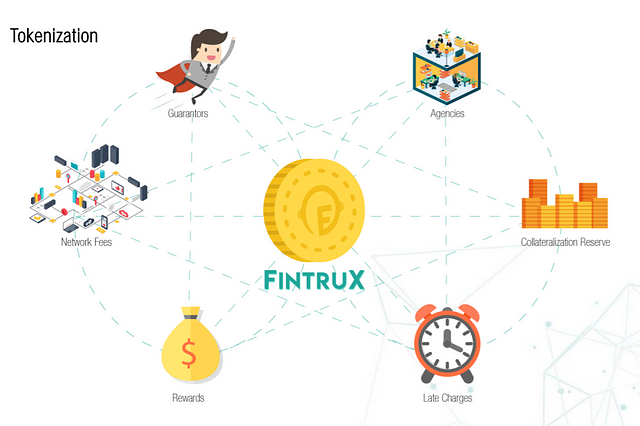

Tokenization :

With the exception of the collateralization pools and currency being

financed, inside the FintruX Network everything is tokenized.Agencies,

guarantors, and FintruX Network are all being paid in FTX Token.

Rewardand late charges toborrowers are paid in FTX Token as well.FintruX

will continuously sell collected tokens back to the participants to

finance the operation and provide liquidity.This creates a token economy

for the limited

supply of FTX Token.

supply of FTX Token.

Fore More Details and ICO

Website : https://www.fintrux.com/

Telegram : https://t.me/FintruX

WhitePaper : https://www.fintrux.com/home/doc/whitepaper.pdf

Comments

Post a Comment